New Hampshire, USA-several reports this week, agree that Cleantech investments fell in 2013, but that's no bad thing. And the big question is what happens next: how much more is needed?

Three new reports of this past week-Bloomberg of new energy finance (BNEF) and Cleantech Group clean energy pipeline-all show that Cleantech investments for a second straight decline in 2013, the year down, although their numbers differ slightly. Bloomberg of new energy finance pegs 2013 the total investment in renewable energy and "smart" energy technologies to $254 billion, down 12 percent from 2012. The Cleantech Group said worldwide venture capital investments dropped 15 percent in 2013 to $6.8 billion. And clean energy pipeline pegs dropoff 20 percent in 2013 new Cleantech investments (up to $212 billion).

Comparing these reviews revealed some patterns and trends:

The largest Cleantech investment in two countries, China and the United States ruled both their Cleantech investment after BNEF--4 per cent for China $61 billion, the first reduction in a decade and 8 percent for the United States $48 billion-while Cleantech investments in Europe, largely subsidy "Fell 41 percent to $58 billion," attributed to constraints. Japan's appetite for Cleantech investment boomed, + 55 percent on $35 Milliarden.Projektfinanzierung total rose 22 percent to clean energy pipeline worldwide, mainly due to the large European offshore wind energy deals. Venture capital (VC) and private equity (PE) were $4.3 billion in 2013 to a third of their weakest since fall 2005. Asset, the financing, the largest area of investment, slipped 13 percent to $149 billion. And small-scale distributed energy investment (in the main roof solar) fell for the first time since 2006 (-25 percent to $60 billion) mainly due to falling prices, BNEF pointed out. M & A transactions were for VC/PE-backed Cleantech companies Cleantech industries at 83 transactions in 2013 (+ 15%), though only a small percentage of those published in the amount of $604 billion (down 37 percent). "Investors continue to capital intensive services and distributed generation, resource sharing, agriculture and the topic digital oilfield in the direction" was Cleantech Group CEO Nambi given to Haji.By invested about 188 offers technology, energy efficiency, the big winner, with $1.3 billion, a $23 per cent higher than 2012 takes the Cleantech Group. BNEF tracks solar investments fall 20 percent to almost $115 billion, wind investments that fall only slightly declining, $80 billion, biomass/waste from 42 per cent to $8 billion and biofuels energy fall 26 percent to $4.9 billion, less than a fifth the peaked in 2006-2007.

But Cleantech investments not extinct, despite some of us believe want to make. Investments increased quarterly nearly 15 percent after five quarters of declining were, says the Cleantech Group. Dollar investments, especially in Europe, not because of label interest but was due to reduced subsidies and the overall falling cost of solar systems, beating BNEF CEO Michael Liebreich. (The other side of the coin: money means cheaper solar energy more bang for the investment.)

After two years of decline, this is only a further proof and confirmation, to clean energy is a tire market. "We have already seen this movie," said Dallas Kachan, Managing Director at Kachan & co. and former Managing Director of the Cleantech Group. In various tech-boom phase, waves of innovation and times of the "Frothiness" had a plateau and correction time-including a dropoff in venture capital-activity-but then new sources of capital came in and drove an upswing the sector life cycle. This is "more recognition, which is this class of technology is here to stay", he said. Would make what is happening in cleantech, provide as the established energy lobbying to undermine prices for renewable energy, and not where sources of capital to come, he proposed.

And wider participation so urgently needed. Another report suggests this week from non-profit sustainability group Ceres, annual Cleantech investment to $500 billion annually until 2020 will be doubled, and increased to $1 trillion by the year 2030 to the objectives of limiting the global warming (up to 2 ° C) and avoid the worst effects of climate change, reducing the demand for electricity and increased use of renewable energy sources, improvement of energy efficiency. (BNEF and Ceres projections from a climate change/investment conference this week organized by Ceres came at the United Nations.) And BNEFs Liebreich suggested, perhaps too conservative - it is possibly more than $2 billion a year be.

Total clean energy investment 2010-2050, in United States $B for a 2 ° C global warming scenario. Credit: IEA, Ceres

Institutional investors managing nearly 76 trillion $ of the balance sheet total, but only a fraction of a percent is way toward cleaner energy infrastructure projects, highlights Ceres. The Group's recommendations: this commitment to increase five percent portfolio-wide for clean energy investment, access to the capital markets with bonds and asset backed securities (we already see, this and more probably comes in 2014); and to support policies for pricing carbon pollution during expansion urge of fossil fuel companies risk positions.

The locks only now starting to open access capital, by deep-pocketed companies use their balance sheets to work to buy their way into the world of Cleantech to the exploitation of multitudes of individual and institutional investors. "There is lot of money still on the sidelines, looking for a way to participate", called Kachan.

View the original article here

Showing posts with label Cleantech. Show all posts

Showing posts with label Cleantech. Show all posts

Wednesday, January 22, 2014

Cleantech of investment cycle: don't worry, think bigger

на 11:54 PM Wednesday, January 22, 2014Ярлыки: bigger, Cleantech, cycle, investment, Think, worry 0 коммент.

Saturday, January 18, 2014

Google Cleantech again increased investments

на 3:00 PM Saturday, January 18, 2014

New Hampshire, USA --again, his muscles prevent investments in renewable energy, takes Google of a stake in one another a Texas wind farm. Oh, and there are also some home buys Energy Automation startup called nest Labs.

This week in the giant Internet that in December it invests $75 million in pattern energy 182 MW 2 Panhandle wind farm in Carson County, Texas, northeast of Amarillo, is expected to be operational by the end of this year. Pattern holds a 80 percent stake in the project, whose owner also Google and two institutional tax equity investors with Morgan Stanley offers included construction and equity bridge loan and a letter of credit.

Google has certainly shown a healthy appetite for Texas Panhandle wind energy. Last fall, what they committed to the issue of EDF renewables 240MW buy Hereford wind park happy southwest of Amarillo. A year ago it below $200 million in EDF threw 161 MW spinning track wind project in Oldham County, Texas, went west of Amarillo, in operating the end of 2012. (Note that spinning EDF takes over track III of Cielo wind power, in case Google approx. 2015 is more investment for power considered.)

This new deal adds yet a more renewable energy spring Google's Cap, cross-cutting projects and procurements from Texas to Finland. Until today the company has committed to more than 1 billion dollars in 15 projects for renewable energy amounting to more than 2 GW electricity annually. That is enough to all public elementary schools in New York, Oregon, and the company makes Wyoming or 500,000 U.S. homes, recalls. Last year the Internet giant over 727.000 MWh purchased renewable energy on long-term contracts, covers 22 percent of its total electricity consumption.

"We believe that companies can be an important new source of capital for the sector of renewable energies," writes Kojo AKO-Asare, Google's senior manager for corporate finance, post to a blog announces the investment.

This is a neat segue to our next Google News entry. While the company to lunch on renewable energy offers further, this week it swallowed its largest meal yet: $3.2 billion for nest Labs, makers of the nest smart thermostat and a newer line of smoke/CO2 alarms. (I'm sorry, who nest as one of the most important predicted expected 2014 IPO offered.) Here is a little sunshine for other Cleantech Investors: the deal means nest of the early VC investors are with 15-20 ? quit many times, including a $400 million payday for Kleiner Perkins Caufield & Byers.

Google has an investment say in the nest for 2011, and the company "has the business resources, achieve global platform, about hardware, software, and services, the nest accelerate growth" Fadell writes in a blog post. "Google helps us fully consciously realize our vision of the House and enable us faster than we ever could, if we remain alone to change the world." We had great momentum, but this is a rocket ship." An Apple news site just explored why buy Google, not Apple, nest: finally home usage data management in accordance with Google's business, while smaller hardware plays as chips is has become more Apple's pursuit. And Google's cash warchest gives him the freedom and wherewithal to take big shots.

The deal is the latest showcase in a $17,000000002 billion years push from its core Web search and advertising platform, and hardware and software. It underlines also the increasing competition between Google and Apple: the two were already at odds over smartphone platforms (iOS vs. Android) and almost a third of the nest 300 employees are Apple expats, including founder Tony Fadell, who helped to design the iPod. (A report suggests, there were even more direct competition and recruitment.)

View the original article here

This week in the giant Internet that in December it invests $75 million in pattern energy 182 MW 2 Panhandle wind farm in Carson County, Texas, northeast of Amarillo, is expected to be operational by the end of this year. Pattern holds a 80 percent stake in the project, whose owner also Google and two institutional tax equity investors with Morgan Stanley offers included construction and equity bridge loan and a letter of credit.

Google has certainly shown a healthy appetite for Texas Panhandle wind energy. Last fall, what they committed to the issue of EDF renewables 240MW buy Hereford wind park happy southwest of Amarillo. A year ago it below $200 million in EDF threw 161 MW spinning track wind project in Oldham County, Texas, went west of Amarillo, in operating the end of 2012. (Note that spinning EDF takes over track III of Cielo wind power, in case Google approx. 2015 is more investment for power considered.)

This new deal adds yet a more renewable energy spring Google's Cap, cross-cutting projects and procurements from Texas to Finland. Until today the company has committed to more than 1 billion dollars in 15 projects for renewable energy amounting to more than 2 GW electricity annually. That is enough to all public elementary schools in New York, Oregon, and the company makes Wyoming or 500,000 U.S. homes, recalls. Last year the Internet giant over 727.000 MWh purchased renewable energy on long-term contracts, covers 22 percent of its total electricity consumption.

"We believe that companies can be an important new source of capital for the sector of renewable energies," writes Kojo AKO-Asare, Google's senior manager for corporate finance, post to a blog announces the investment.

This is a neat segue to our next Google News entry. While the company to lunch on renewable energy offers further, this week it swallowed its largest meal yet: $3.2 billion for nest Labs, makers of the nest smart thermostat and a newer line of smoke/CO2 alarms. (I'm sorry, who nest as one of the most important predicted expected 2014 IPO offered.) Here is a little sunshine for other Cleantech Investors: the deal means nest of the early VC investors are with 15-20 ? quit many times, including a $400 million payday for Kleiner Perkins Caufield & Byers.

Google has an investment say in the nest for 2011, and the company "has the business resources, achieve global platform, about hardware, software, and services, the nest accelerate growth" Fadell writes in a blog post. "Google helps us fully consciously realize our vision of the House and enable us faster than we ever could, if we remain alone to change the world." We had great momentum, but this is a rocket ship." An Apple news site just explored why buy Google, not Apple, nest: finally home usage data management in accordance with Google's business, while smaller hardware plays as chips is has become more Apple's pursuit. And Google's cash warchest gives him the freedom and wherewithal to take big shots.

The deal is the latest showcase in a $17,000000002 billion years push from its core Web search and advertising platform, and hardware and software. It underlines also the increasing competition between Google and Apple: the two were already at odds over smartphone platforms (iOS vs. Android) and almost a third of the nest 300 employees are Apple expats, including founder Tony Fadell, who helped to design the iPod. (A report suggests, there were even more direct competition and recruitment.)

View the original article here

Ярлыки: again, Cleantech, Google, increased, Investments 0 коммент.

Tuesday, December 17, 2013

Predictions for Cleantech in 2014

на 8:00 AM Tuesday, December 17, 2013

Dallas Kachan

Continuing a tradition since 2007, once again, we bring you some at the end of the year thoughts about where we think that the Cleantech investment theme is.

Our Cleantech-specific analysis and consulting focuses on this area fixed Kachan & co.. We publish research reports. We received briefings from companies, the introduction of new technologies. We publish a Cleantech analysis service. We are cited in the press. We pore over what is happening in the world in clean / Green Tech markets and have some profound calls over the years, as Chinese Cleantech domination, the rise of technologies and the decline of the Cleantech Venture capital funding.

This year, we are of the opinion that industry watchers should take to heart. Especially if you was on the page, that Cleantech late past his prime or otherwise unworthy your attention. Why? Because we are more optimistic, what the coming year of Cleantech in the last two years our predictions (read 2012 and 2013), which are unusual for a company were negative was often something like a cheerleader for the Cleantech space.

What is different this year? As you read below, we believe that the world turned an important corner in Cleantech in 2013.

Gradual recovery in 2014

If you have not carefully searched the last year in the tea leaves, you might have missed the quiet recovery already underway in cleantech, a process that the we expect more dynamic until 2014 to get.

We had the chance, an insight into the basics of the Cleantech this fall who co-authored a new (and free) 38-page research report. Titled Cleantech new: Why, the next wave of Cleantech will flourish in the twenty-first century infrastructure, technology and services, analyzed the paper the recent investments research in a number of sectors and areas of influence.

A section of the report compares the Cleantech wave to other technology booms of the last 50 years, as the dotcom boom, the networking craze, biotech, the PC and the microprocessor. We found a number of parallel and a number of reasons for optimism compare the cycles. After 20 years in the technology felt personally, as I looked more at the data, the more it, I would have seen this movie before. After an initial Frothiness and correction, there's always a resetting of expectations and execution and a gradual "climb out" of the trough. A hype cycle is called Gartner. And climbing today we are past the worst in Cleantech.

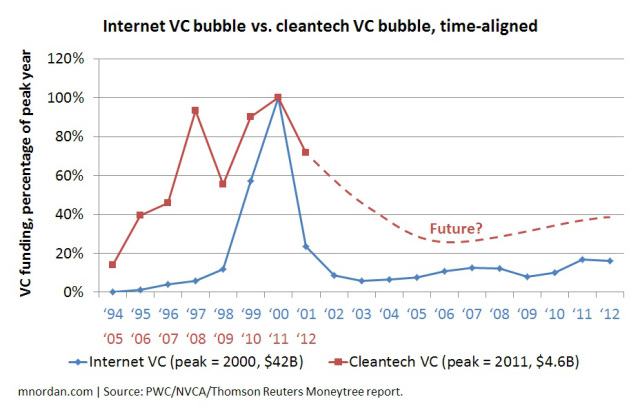

The recent decline in the venture-capital investments in Cleantech does not mean that the sky is falling. Dip is less threatening, when in the historical context as risk capital always early in new categories spikes, later extended with other sources of capital, such as often unreported corporate and family Office investment, develop such industries as displayed. It happened in the dot com, Cleantech is currently well as shown below networking, biotechnology and PC eras, and this transition. We offer much more detail with extra numbers and graphs, in our report.

While venture capital most important source for clean technology 2008 year was financing in California, it played a smaller role in 2012. Source: CB insights, collaborative economics. Closes the project financing and non-associated investments.

An another takeaway from the preceding: Pay less attention in these days, to venture capital investment as an indicator of the health of the Cleantech space. Risking to see not the real picture.

In addition to an analysis of the pattern in venture financing in previous bubbles vs. What is happening today in the Cleantech looks our 38-page analysis of the State of the Cleantech investment in clean and green innovations and projects total today. It considered, what is from models such as the technology adoption life cycle (from "Schism" fame.) It takes into account the recent recovery of the publicly traded Cleantech funds and other metrics.

All in all what we learned on the basis of writing this report, we forecast a sustained recovery in Cleantech. Not a lush - we bet that those days are past - looking but for a clear upward trend in many things Cleantech in 2014, so companies, private equity and family Office investment, venture debt, project finance, M & A, interesting new innovations, new product announcements, etc.. But improves your breath for classical venture investments.

Term Cleantech, to remain alive and well

There is speculation about whether the term "Cleantech", that will be credited to my previous company with the embossing will or should be preserved. My colleagues sometimes suggested the sentence should go - that our task was it, to make sure that clean and green sets are finally added for all products, that all forms of energy become clean, that all synthetic chemistry and toxins with natural, biological solutions be replaced because this ultimately less expensive and possibly only real possibilities for other people on the planet are.

The information and opinions in this blog are solely those of the author and not necessarily the RenewableEnergyWorld.com and company, the advertising on this Web site and other publications. This blog has been posted directly by the author and has not been reviewed for accuracy, spelling or grammar.

View the original article here

Continuing a tradition since 2007, once again, we bring you some at the end of the year thoughts about where we think that the Cleantech investment theme is.

Our Cleantech-specific analysis and consulting focuses on this area fixed Kachan & co.. We publish research reports. We received briefings from companies, the introduction of new technologies. We publish a Cleantech analysis service. We are cited in the press. We pore over what is happening in the world in clean / Green Tech markets and have some profound calls over the years, as Chinese Cleantech domination, the rise of technologies and the decline of the Cleantech Venture capital funding.

This year, we are of the opinion that industry watchers should take to heart. Especially if you was on the page, that Cleantech late past his prime or otherwise unworthy your attention. Why? Because we are more optimistic, what the coming year of Cleantech in the last two years our predictions (read 2012 and 2013), which are unusual for a company were negative was often something like a cheerleader for the Cleantech space.

What is different this year? As you read below, we believe that the world turned an important corner in Cleantech in 2013.

Gradual recovery in 2014

If you have not carefully searched the last year in the tea leaves, you might have missed the quiet recovery already underway in cleantech, a process that the we expect more dynamic until 2014 to get.

We had the chance, an insight into the basics of the Cleantech this fall who co-authored a new (and free) 38-page research report. Titled Cleantech new: Why, the next wave of Cleantech will flourish in the twenty-first century infrastructure, technology and services, analyzed the paper the recent investments research in a number of sectors and areas of influence.

A section of the report compares the Cleantech wave to other technology booms of the last 50 years, as the dotcom boom, the networking craze, biotech, the PC and the microprocessor. We found a number of parallel and a number of reasons for optimism compare the cycles. After 20 years in the technology felt personally, as I looked more at the data, the more it, I would have seen this movie before. After an initial Frothiness and correction, there's always a resetting of expectations and execution and a gradual "climb out" of the trough. A hype cycle is called Gartner. And climbing today we are past the worst in Cleantech.

The recent decline in the venture-capital investments in Cleantech does not mean that the sky is falling. Dip is less threatening, when in the historical context as risk capital always early in new categories spikes, later extended with other sources of capital, such as often unreported corporate and family Office investment, develop such industries as displayed. It happened in the dot com, Cleantech is currently well as shown below networking, biotechnology and PC eras, and this transition. We offer much more detail with extra numbers and graphs, in our report.

While venture capital most important source for clean technology 2008 year was financing in California, it played a smaller role in 2012. Source: CB insights, collaborative economics. Closes the project financing and non-associated investments.

An another takeaway from the preceding: Pay less attention in these days, to venture capital investment as an indicator of the health of the Cleantech space. Risking to see not the real picture.

In addition to an analysis of the pattern in venture financing in previous bubbles vs. What is happening today in the Cleantech looks our 38-page analysis of the State of the Cleantech investment in clean and green innovations and projects total today. It considered, what is from models such as the technology adoption life cycle (from "Schism" fame.) It takes into account the recent recovery of the publicly traded Cleantech funds and other metrics.

All in all what we learned on the basis of writing this report, we forecast a sustained recovery in Cleantech. Not a lush - we bet that those days are past - looking but for a clear upward trend in many things Cleantech in 2014, so companies, private equity and family Office investment, venture debt, project finance, M & A, interesting new innovations, new product announcements, etc.. But improves your breath for classical venture investments.

Term Cleantech, to remain alive and well

There is speculation about whether the term "Cleantech", that will be credited to my previous company with the embossing will or should be preserved. My colleagues sometimes suggested the sentence should go - that our task was it, to make sure that clean and green sets are finally added for all products, that all forms of energy become clean, that all synthetic chemistry and toxins with natural, biological solutions be replaced because this ultimately less expensive and possibly only real possibilities for other people on the planet are.

The information and opinions in this blog are solely those of the author and not necessarily the RenewableEnergyWorld.com and company, the advertising on this Web site and other publications. This blog has been posted directly by the author and has not been reviewed for accuracy, spelling or grammar.

View the original article here

Ярлыки: Cleantech, Predictions 0 коммент.

Sunday, October 27, 2013

New Optimism for a Cleantech Future

на 2:12 AM Sunday, October 27, 2013

If you've not been paying much attention to cleantech in the last little while, it's time to sit up and take notice — because post-Solyndra, cleantech has been quietly gaining momentum.

We had the chance to take a close look at the fundamentals of cleantech over the last two months in co-authoring a new (and free!) 38-page research report in conjunction with Oakland, Calif.-based advocacy group As You Sow and the Responsible Endowments Coalition of Brooklyn, New York.

Titled Cleantech Redefined: Why the next wave of cleantech infrastructure, technology and services will thrive in the twenty first century, the paper analyzes the most recent investment research available across a number of industries and major impact areas. It identifies key drivers and market size projections for various cleantech categories. It looks at examples of products and technologies currently on the market. Finally, it highlights a handful of large, mid and small cap firms and funds as possible points of entry for investors within each industry.

The paper does a good job of introducing cleantech and its significance (e.g. even only being a relatively new investment theme, cleantech is still — even today after a downturn — attracting nearly a quarter of global venture capital available.) It re-emphasizes cleantech's multi-trillion dollar individual addressable markets of power, water, agriculture, transportation and others. And it restates the significance of cleantech's drivers, and that they're not going away any time soon.

But to me, one of the most interesting sections of the report compares the cleantech wave to other technology booms of the last 50 years, like the dot com boom, the networking craze, biotech, the PC and the microprocessor. We found a number of parallels and a number of reasons for optimism when you compare the cycles. After 20 years in technology, personally, the more I looked at the data, the more it felt like I'd seen this movie before.

For instance, the downturn in venture capital: Venture capital often spikes early in emerging categories, later to be replaced with more traditional levels of investment and other sources of capital as industries develop. It happened in the Internet era, and this transition has begun in cleantech as shown below; venture capital is playing less of a leading role in driving cutting edge technology, as it's being being augmented by corporate investors and other sources of funds. More detail in our report.

Actual and estimated venture capital spending in Internet and cleantech. Source: Matthew Nordan

There's another relevant curve, below, that looks a lot like the one above. We hypothesized in an analysis this summer that cleantech had bottomed out on the Gartner hype cycle. We make the more detailed case in our report that cleantech, as in every one of the previous waves I just mentioned, had experienced the same initial enthusiasm, the same frothiness, the same "irrational exuberance" as Alan Greenspan put it, that these other technologies did as expectations initially exceeded reality.

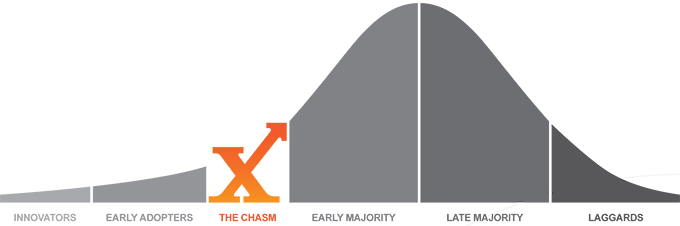

As the Gartner model below illustrates, in every one of these previous waves, there was a correction, and a gradual equalization of expectations and execution. Our analysis, detailed in our report, is that cleantech is now starting to climb out of what Gartner calls the "trough of disillusionment" and up the "slope of enlightenment" (how very Zen).

Hype cycle of expectations over time related to cleantech. Source: Gartner

And cleantech IS climbing out. If you look at broad-based cleantech funds as a proxy for the cleantech theme, there's been solid growth the last few months. Yes, cleantech returns have been generally poor for investors the last few years. But there have been bright spots in certain sub-sectors such as clean energy generation, solar services and transportation. The lift from high cleantech fliers like SolarCity (NASDAQ: SCTY) and Tesla Motors (NASDAQ: TSA) is pulling up the rest of the category, as shown in the performance of the PowerShares Cleantech Portfolio fund, a mix of public stocks from across the cleantech definition.

PowerShares Cleantech Portfolio fund (PZD) performance, 2007 to 2013. Source: Google Finance

Another reason our report finds optimism for the cleantech space is in looking at cleantech's various industries through the lens of the technology adoption lifecycle model, a curve popularized by the marketing strategy firm Regis McKenna in Palo Alto, California, where I served as a senior consultant in the mid 90s. I wrote in 2011 about the significance of this model to cleantech, and our new report echoes and expands on this analysis. If the vast majority of clean technologies, services and infrastructure plays have yet to cross the chasm, it means risk and expense getting there, but it also means massively larger market adoption on the other side.

In the widely accepted technology adoption lifecycle model, a market gap exists between early adopters of new technologies and the majority of consumers. This gap is especially treacherous for companies that develop disruptive technologies, as they force a significant change to the markets they target. Only companies nimble enough to transition from the early adopter market (consumers motivated by purchasing the latest technologies for competitive benefit) to the early majority of the vastly larger mainstream market (which prefers to buy established technology) are successful.

The technology adoption lifecycle and chasm model, Regis McKenna. Source: Joe M. Bohlen, George M. Beal and Everett M. Rogers

Different clean technologies have faced their mainstream adoption chasms at different times. For example, wind and solar energy power generation have already bridged the gap. They are now widely understood and increasingly deployed by renewable energy decision makers at power companies, and by individual businesses and homeowners. Algae fuel, for example, is on the far left side of the chart — exciting but yet to scale.

The adoption chasm of new technologies can differ substantially in magnitude. Many cleantech products have been quietly moving the needle on efficiency and waste reduction without fundamentally altering their markets. Lighting is a good example. The transition from incandescent to fluorescents to light emitting diodes (LED) happened without dramatic market disruption. Consumers had a small technology curve to overcome, but the lighting market still requires the purchase of light bulbs. We expect a significant segment of the cleantech transition will happen in this way, with cost and efficiency driving marginal, but resource-significant product changes.

So, in all, our new report finds that cleantech is here, today, now. It observes that efficiency, one of the central tenets of cleantech, is now a theme of almost everything now made, and of how it's designed and manufactured. Cleantech is becoming ubiquitous — from cheaper, more efficient lighting to advanced metering software. Cleantech in all of its forms is poised for even more rapid expansion, especially now that the largest companies in the world have discovered the opportunity and imperative of cost savings...and now that individual technologies are beginning to cross the chasm to mainstream adoption.

As our report concludes, we're just at the beginning of this phenomenon called cleantech. The best and most exciting investment opportunities are yet to come.

This article was originally published here and was republished with permission.

A former managing director of the Cleantech Group, Dallas Kachan is now managing partner of Kachan & Co., a cleantech research and advisory firm that does business worldwide from San Francisco, Toronto and Vancouver. The company publishes research on clean technology companies and future trends, offers cleantech data and analysis via its Cleantech Watch™ service and offers consulting services to large corporations, governments, service providers and cleantech vendors. Kachan staff have been covering, publishing about and helping propel clean technology since 2006. Details at www.kachan.com.

The information and views expressed in this blog post are solely those of the author and not necessarily those of RenewableEnergyWorld.com or the companies that advertise on this Web site and other publications. This blog was posted directly by the author and was not reviewed for accuracy, spelling or grammar.

View the original article here

We had the chance to take a close look at the fundamentals of cleantech over the last two months in co-authoring a new (and free!) 38-page research report in conjunction with Oakland, Calif.-based advocacy group As You Sow and the Responsible Endowments Coalition of Brooklyn, New York.

Titled Cleantech Redefined: Why the next wave of cleantech infrastructure, technology and services will thrive in the twenty first century, the paper analyzes the most recent investment research available across a number of industries and major impact areas. It identifies key drivers and market size projections for various cleantech categories. It looks at examples of products and technologies currently on the market. Finally, it highlights a handful of large, mid and small cap firms and funds as possible points of entry for investors within each industry.

The paper does a good job of introducing cleantech and its significance (e.g. even only being a relatively new investment theme, cleantech is still — even today after a downturn — attracting nearly a quarter of global venture capital available.) It re-emphasizes cleantech's multi-trillion dollar individual addressable markets of power, water, agriculture, transportation and others. And it restates the significance of cleantech's drivers, and that they're not going away any time soon.

But to me, one of the most interesting sections of the report compares the cleantech wave to other technology booms of the last 50 years, like the dot com boom, the networking craze, biotech, the PC and the microprocessor. We found a number of parallels and a number of reasons for optimism when you compare the cycles. After 20 years in technology, personally, the more I looked at the data, the more it felt like I'd seen this movie before.

For instance, the downturn in venture capital: Venture capital often spikes early in emerging categories, later to be replaced with more traditional levels of investment and other sources of capital as industries develop. It happened in the Internet era, and this transition has begun in cleantech as shown below; venture capital is playing less of a leading role in driving cutting edge technology, as it's being being augmented by corporate investors and other sources of funds. More detail in our report.

Actual and estimated venture capital spending in Internet and cleantech. Source: Matthew Nordan

There's another relevant curve, below, that looks a lot like the one above. We hypothesized in an analysis this summer that cleantech had bottomed out on the Gartner hype cycle. We make the more detailed case in our report that cleantech, as in every one of the previous waves I just mentioned, had experienced the same initial enthusiasm, the same frothiness, the same "irrational exuberance" as Alan Greenspan put it, that these other technologies did as expectations initially exceeded reality.

As the Gartner model below illustrates, in every one of these previous waves, there was a correction, and a gradual equalization of expectations and execution. Our analysis, detailed in our report, is that cleantech is now starting to climb out of what Gartner calls the "trough of disillusionment" and up the "slope of enlightenment" (how very Zen).

Hype cycle of expectations over time related to cleantech. Source: Gartner

And cleantech IS climbing out. If you look at broad-based cleantech funds as a proxy for the cleantech theme, there's been solid growth the last few months. Yes, cleantech returns have been generally poor for investors the last few years. But there have been bright spots in certain sub-sectors such as clean energy generation, solar services and transportation. The lift from high cleantech fliers like SolarCity (NASDAQ: SCTY) and Tesla Motors (NASDAQ: TSA) is pulling up the rest of the category, as shown in the performance of the PowerShares Cleantech Portfolio fund, a mix of public stocks from across the cleantech definition.

PowerShares Cleantech Portfolio fund (PZD) performance, 2007 to 2013. Source: Google Finance

Another reason our report finds optimism for the cleantech space is in looking at cleantech's various industries through the lens of the technology adoption lifecycle model, a curve popularized by the marketing strategy firm Regis McKenna in Palo Alto, California, where I served as a senior consultant in the mid 90s. I wrote in 2011 about the significance of this model to cleantech, and our new report echoes and expands on this analysis. If the vast majority of clean technologies, services and infrastructure plays have yet to cross the chasm, it means risk and expense getting there, but it also means massively larger market adoption on the other side.

In the widely accepted technology adoption lifecycle model, a market gap exists between early adopters of new technologies and the majority of consumers. This gap is especially treacherous for companies that develop disruptive technologies, as they force a significant change to the markets they target. Only companies nimble enough to transition from the early adopter market (consumers motivated by purchasing the latest technologies for competitive benefit) to the early majority of the vastly larger mainstream market (which prefers to buy established technology) are successful.

The technology adoption lifecycle and chasm model, Regis McKenna. Source: Joe M. Bohlen, George M. Beal and Everett M. Rogers

Different clean technologies have faced their mainstream adoption chasms at different times. For example, wind and solar energy power generation have already bridged the gap. They are now widely understood and increasingly deployed by renewable energy decision makers at power companies, and by individual businesses and homeowners. Algae fuel, for example, is on the far left side of the chart — exciting but yet to scale.

The adoption chasm of new technologies can differ substantially in magnitude. Many cleantech products have been quietly moving the needle on efficiency and waste reduction without fundamentally altering their markets. Lighting is a good example. The transition from incandescent to fluorescents to light emitting diodes (LED) happened without dramatic market disruption. Consumers had a small technology curve to overcome, but the lighting market still requires the purchase of light bulbs. We expect a significant segment of the cleantech transition will happen in this way, with cost and efficiency driving marginal, but resource-significant product changes.

So, in all, our new report finds that cleantech is here, today, now. It observes that efficiency, one of the central tenets of cleantech, is now a theme of almost everything now made, and of how it's designed and manufactured. Cleantech is becoming ubiquitous — from cheaper, more efficient lighting to advanced metering software. Cleantech in all of its forms is poised for even more rapid expansion, especially now that the largest companies in the world have discovered the opportunity and imperative of cost savings...and now that individual technologies are beginning to cross the chasm to mainstream adoption.

As our report concludes, we're just at the beginning of this phenomenon called cleantech. The best and most exciting investment opportunities are yet to come.

This article was originally published here and was republished with permission.

A former managing director of the Cleantech Group, Dallas Kachan is now managing partner of Kachan & Co., a cleantech research and advisory firm that does business worldwide from San Francisco, Toronto and Vancouver. The company publishes research on clean technology companies and future trends, offers cleantech data and analysis via its Cleantech Watch™ service and offers consulting services to large corporations, governments, service providers and cleantech vendors. Kachan staff have been covering, publishing about and helping propel clean technology since 2006. Details at www.kachan.com.

The information and views expressed in this blog post are solely those of the author and not necessarily those of RenewableEnergyWorld.com or the companies that advertise on this Web site and other publications. This blog was posted directly by the author and was not reviewed for accuracy, spelling or grammar.

View the original article here

Ярлыки: Cleantech, future, Optimism 0 коммент.

Friday, August 16, 2013

Cleantech turnaround report showing renewable energy recovery

на 9:30 AM Friday, August 16, 2013

London-despite a difficult market environment, key indicators show signs of improvement in the field of clean tech published after yo of the new annual performance report of the Cleantech industry bankruptcies and consolidation.

"The cleantech sector has shifted worldwide growth. Resource scarcity, energy security concerns, population growth and rising consumption due to the expansion of the middle class in emerging markets continues this Cleantech market growth."--Gil Forer, EYs Cleantech leader

Finding a bounce back in market capitalization, the financial strength of the public pure-play (PPP) strengthened energy efficiency and renewable energy,-Cleantech companies has improved, while their number has grown around the world, the document concludes.

Global, the establishment saw the cleantech sector 68 new PPP-companies in the year 2012 and lost 63 companies during the same period. The United States and China remain leading countries in terms of PPP companies with 70 and 64, or during the Asia-Pacific region as a growth driver, with China's leading number of employees caused growth. Indeed, the Asia-Pacific region was the main winner, increasing by 16 percent to 177 companies, while the company population in Europe, Middle East and Africa (EMEA) shrank 8 percent to 135 companies.

The renewable energy sector occupied important signs of recovery as a sugar-producing undertaking showed about the Board gains benefit from lower cost of equipment. The number of companies rose by 14 percent to 32, stock market capitalization rose by 8 percent to US $25.5 billion and revenue increased by 23 percent to $11.1 billion, EY means.

While the number of wind equipment company around fell 2 percent to 53, market capitalization rose 14 percent to $35.3 billion increased 2 percent to $30.8 billion and revenues. However, the picture for solar more decline by 2 per cent but is mixed market capitalization with the number of solar installation companies by 14 percent to $28.8 billion. However, according to this analysis, solar sales decreased by 16 per cent to $42.5 billion.

Increased bio-fuels, which scored a 8 percent to 41, market capitalization in the year 2012 as the number of companies in the segment also experienced significant growth by 25 percent to $13.1 billion and revenue grew 14 percent to $26 billion.

Commented on the results of Gil Forer, EY is the Cleantech world leader, says: "we have seen a remarkable recovery in the performance of 424 public pure-play-Cleantech companies around the world. Despite a difficult time consolidation in certain Cleantech segments, tax issues in some countries, and the lingering effects of the financial crisis; "We have seen an annual profit of 18 percent of market capitalization and [a] 12 percent staff reduction."

According to the research of the global workforce of public Cleantech companies, is 512.500 with China, as more than half of the global workforce, the source of growth, under the direction of supplements in the solar and wind segments around the world.

Forer concluded: "the cleantech sector worldwide has shifted on growth. Resource scarcity, energy security concerns, population growth and increasing consumption, by expanding the middle class in emerging markets continue to drive the growth of Cleantech market. "China consolidates its position as the most important Cleantech market and prepared for the inevitability as the number one Center for public Cleantech companies."

View the original article here

"The cleantech sector has shifted worldwide growth. Resource scarcity, energy security concerns, population growth and rising consumption due to the expansion of the middle class in emerging markets continues this Cleantech market growth."--Gil Forer, EYs Cleantech leader

Finding a bounce back in market capitalization, the financial strength of the public pure-play (PPP) strengthened energy efficiency and renewable energy,-Cleantech companies has improved, while their number has grown around the world, the document concludes.

Global, the establishment saw the cleantech sector 68 new PPP-companies in the year 2012 and lost 63 companies during the same period. The United States and China remain leading countries in terms of PPP companies with 70 and 64, or during the Asia-Pacific region as a growth driver, with China's leading number of employees caused growth. Indeed, the Asia-Pacific region was the main winner, increasing by 16 percent to 177 companies, while the company population in Europe, Middle East and Africa (EMEA) shrank 8 percent to 135 companies.

The renewable energy sector occupied important signs of recovery as a sugar-producing undertaking showed about the Board gains benefit from lower cost of equipment. The number of companies rose by 14 percent to 32, stock market capitalization rose by 8 percent to US $25.5 billion and revenue increased by 23 percent to $11.1 billion, EY means.

While the number of wind equipment company around fell 2 percent to 53, market capitalization rose 14 percent to $35.3 billion increased 2 percent to $30.8 billion and revenues. However, the picture for solar more decline by 2 per cent but is mixed market capitalization with the number of solar installation companies by 14 percent to $28.8 billion. However, according to this analysis, solar sales decreased by 16 per cent to $42.5 billion.

Increased bio-fuels, which scored a 8 percent to 41, market capitalization in the year 2012 as the number of companies in the segment also experienced significant growth by 25 percent to $13.1 billion and revenue grew 14 percent to $26 billion.

Commented on the results of Gil Forer, EY is the Cleantech world leader, says: "we have seen a remarkable recovery in the performance of 424 public pure-play-Cleantech companies around the world. Despite a difficult time consolidation in certain Cleantech segments, tax issues in some countries, and the lingering effects of the financial crisis; "We have seen an annual profit of 18 percent of market capitalization and [a] 12 percent staff reduction."

According to the research of the global workforce of public Cleantech companies, is 512.500 with China, as more than half of the global workforce, the source of growth, under the direction of supplements in the solar and wind segments around the world.

Forer concluded: "the cleantech sector worldwide has shifted on growth. Resource scarcity, energy security concerns, population growth and increasing consumption, by expanding the middle class in emerging markets continue to drive the growth of Cleantech market. "China consolidates its position as the most important Cleantech market and prepared for the inevitability as the number one Center for public Cleantech companies."

View the original article here

Ярлыки: Cleantech, Energy, recovery, renewable, report, showing, turnaround 0 коммент.

Saturday, July 20, 2013

Cleantech Investments A Mixed Bag in 2Q13, But VCs Are Warming Up To Solar

на 2:49 AM Saturday, July 20, 2013

New Hampshire, USA -- Investments in the renewable energy sector were a mixed bag during the second quarter of 2013, according to a trio of analyst reports and many of the same trends we've seen lately persist: the U.S. and Asia-Pacific regions were more active, and downstream activity continues to intensify.

Taking the broadest view, Bloomberg New Energy Finance (BNEF) tallies $53.1 billion in global clean energy investments in 2Q13, up 22 percent from the prior quarter, though down about 16 percent from a year ago. An upswing in investments in the U.S. and China was offset by declines in Europe and globally overall: China was the biggest cleantech investor at $13.8 billion, with the U.S. at $9.5 billion, while investments in Germany and the U.K. fell precipitously from a year ago (to $1.9 billion and $1.7 billion, respectively). South Africa surprised analysts with $2.8 billion in 2Q13 cleantech investments, "up from almost nothing" in the first three months of 2013. Biggest beneficiaries of more financing were wind and solar projects, especially utility-scale ones. Another metric: asset finance was split roughly 70/30 between domestic and cross-border investments. (Here's a video summing up the BNEF cleantech investment findings.)

The Cleantech Group, meanwhile, cites $1.76 billion specifically in global cleantech venture investments in 2Q13, a 56 percent surge from 1Q13, though the number of total deals was off from 1Q13's record high (214 vs. 246). North American venture investments leaped 74 percent to $1.25 billion, while the Asia-Pacific totaled $267 million -- far more money than in 1Q13 for the same number of deals -- and Europe saw less activity in both dollars and deals. Energy efficiency companies secured the most cleantech funding ($378 million), followed by biofuels/biochemicals ($231 million) and solar ($170 million). Bloom Energy (fuel cells), Intrexon (biotech), Skyonic (carbon capture/reuse), China XEMC (wind turbine components), Hefei (solar projects), Blu Homes (energy efficient homes), View (nee Soladigm, energy-efficient glass), Aligned Energy (energy-efficient data centers), and Lampris (renewable energy).

And narrowing even further to just the solar sector, Mercom Capital reports VC investments increased in dollar amounts in 2Q13 from the prior quarter ($189 million vs. $126 million) but the number of deals was down (19 vs. 26), suggesting that investors are interested in the sector but are increasingly picky. Top fundraisers were Chinese solar developer Hefei Golden Sun (raising $69 million) and Clean Power Finance ($42 million), with three other investments coming in between $10-$15 million. Most of the funding momentum continues to head downstream: third-party solar plays topped another record $1.33 billion in publicly-announced residential and commercial solar project funds -- already on par with what was raised during all of 2012. And large-scale project funding totaled $2.94 billion, up from $1.77 billion in 1Q13, including a record $1 billion solar bond offering by MidAmerican Energy subsidiary Solar Star Funding. Another interesting numerical nugget from Mercom: Chinese banks have pledged $53 billion to date in loans, credit facilities, and other types of debt agreements.

Know When to Hold 'Em...

Conversations with startups and a panel session at last week's Intersolar North America pointed to renewed interest from the VC community to put money into solar again, according to Fatima Toor, senior analyst at Lux Research. "Certainly the money going downstream is much more significant, but the fact is there's general interest."

What's been happening for several quarters now, points out Raj Prabhu, managing partner at Mercom Capital, is that funding activity has been below par and money's still tight -- take out that big Hefei deal and the solar sector activity was basically flat in 2Q13, he notes. Companies further downstream, including projects, continue to be the most active funding areas compared with more upstream manufacturing-centric ones. "After all the money that went into thin-film, CSP, CPV companies with no returns, VCs are very, very skeptical," he said.

Solar VC Funding, 2Q13. Credit: Mercom Capital Group LLC

Nevertheless, "when there's a unique technology it still gets funded," he said, citing recent examples in Solexel and Scifiniti. The central message is that investor insterest lies in technologies that are not new and unique, but rather ones that "can improve on existing technology and efficiency a little bit, cut costs here or there, and improve processes," he said. "These are the types we're seeing so far." Lately, for example, he's been seeing more activity in high-efficiency solar panels (specifically monocrystalline silicon tech) and an increased focus on commercial and residential installations.

One positive indicator is that more financial institutions and investment groups are getting involved in solar project acquisitions, because of the calculated returns. "Solar has reached the point in the last 12 months or so where investors do feel it's safe enough, especially institutional investors, and expect a healthy return," he said. He's also seeing more use of bonds to finance projects, which "shows some maturity for solar as an asset class." With bond interest above 5 percent, "where can you park your money right now in the U.S. and get five-plus percent? You can't even get a percent for a CD," Praghu said. With money abundantly available thanks to friendlier federal policies, "5 percent looks like a really good bet, with a lower risk profile," he said.

... And Know When to Fold 'Em

Part of the mindset of an investor is knowing how to identify and ride an early wave of success -- and knowing when to get off the ride. In the case of the boon in solar third-party funding, "that's what a lot of people are wondering," Prabhu said. The third-party business model, which relies heavily on vendors taking the tax credits, has some fundamental uncertainty once the 30 percent investment tax credit (ITC) times out in 2016. And if prices continue to come down, will solar become so attractive that direct ownership makes more sense than leasing? As investors, particularly those who look ahead to annual tax obligations, start to look at solar investments, the thinking around these types of concerns "has to evolve pretty soon," he said.

One last data point Prabhu points out: bankruptcies and insolvencies are actually dropping, roughly half what they were at this time a year ago. "That's what I look at when I tell people, 'we're a little better off than where we were,'" he said. "But [we're] not completely off the hook."

View the original article here

Taking the broadest view, Bloomberg New Energy Finance (BNEF) tallies $53.1 billion in global clean energy investments in 2Q13, up 22 percent from the prior quarter, though down about 16 percent from a year ago. An upswing in investments in the U.S. and China was offset by declines in Europe and globally overall: China was the biggest cleantech investor at $13.8 billion, with the U.S. at $9.5 billion, while investments in Germany and the U.K. fell precipitously from a year ago (to $1.9 billion and $1.7 billion, respectively). South Africa surprised analysts with $2.8 billion in 2Q13 cleantech investments, "up from almost nothing" in the first three months of 2013. Biggest beneficiaries of more financing were wind and solar projects, especially utility-scale ones. Another metric: asset finance was split roughly 70/30 between domestic and cross-border investments. (Here's a video summing up the BNEF cleantech investment findings.)

The Cleantech Group, meanwhile, cites $1.76 billion specifically in global cleantech venture investments in 2Q13, a 56 percent surge from 1Q13, though the number of total deals was off from 1Q13's record high (214 vs. 246). North American venture investments leaped 74 percent to $1.25 billion, while the Asia-Pacific totaled $267 million -- far more money than in 1Q13 for the same number of deals -- and Europe saw less activity in both dollars and deals. Energy efficiency companies secured the most cleantech funding ($378 million), followed by biofuels/biochemicals ($231 million) and solar ($170 million). Bloom Energy (fuel cells), Intrexon (biotech), Skyonic (carbon capture/reuse), China XEMC (wind turbine components), Hefei (solar projects), Blu Homes (energy efficient homes), View (nee Soladigm, energy-efficient glass), Aligned Energy (energy-efficient data centers), and Lampris (renewable energy).

And narrowing even further to just the solar sector, Mercom Capital reports VC investments increased in dollar amounts in 2Q13 from the prior quarter ($189 million vs. $126 million) but the number of deals was down (19 vs. 26), suggesting that investors are interested in the sector but are increasingly picky. Top fundraisers were Chinese solar developer Hefei Golden Sun (raising $69 million) and Clean Power Finance ($42 million), with three other investments coming in between $10-$15 million. Most of the funding momentum continues to head downstream: third-party solar plays topped another record $1.33 billion in publicly-announced residential and commercial solar project funds -- already on par with what was raised during all of 2012. And large-scale project funding totaled $2.94 billion, up from $1.77 billion in 1Q13, including a record $1 billion solar bond offering by MidAmerican Energy subsidiary Solar Star Funding. Another interesting numerical nugget from Mercom: Chinese banks have pledged $53 billion to date in loans, credit facilities, and other types of debt agreements.

Know When to Hold 'Em...

Conversations with startups and a panel session at last week's Intersolar North America pointed to renewed interest from the VC community to put money into solar again, according to Fatima Toor, senior analyst at Lux Research. "Certainly the money going downstream is much more significant, but the fact is there's general interest."

What's been happening for several quarters now, points out Raj Prabhu, managing partner at Mercom Capital, is that funding activity has been below par and money's still tight -- take out that big Hefei deal and the solar sector activity was basically flat in 2Q13, he notes. Companies further downstream, including projects, continue to be the most active funding areas compared with more upstream manufacturing-centric ones. "After all the money that went into thin-film, CSP, CPV companies with no returns, VCs are very, very skeptical," he said.

Solar VC Funding, 2Q13. Credit: Mercom Capital Group LLC

Nevertheless, "when there's a unique technology it still gets funded," he said, citing recent examples in Solexel and Scifiniti. The central message is that investor insterest lies in technologies that are not new and unique, but rather ones that "can improve on existing technology and efficiency a little bit, cut costs here or there, and improve processes," he said. "These are the types we're seeing so far." Lately, for example, he's been seeing more activity in high-efficiency solar panels (specifically monocrystalline silicon tech) and an increased focus on commercial and residential installations.

One positive indicator is that more financial institutions and investment groups are getting involved in solar project acquisitions, because of the calculated returns. "Solar has reached the point in the last 12 months or so where investors do feel it's safe enough, especially institutional investors, and expect a healthy return," he said. He's also seeing more use of bonds to finance projects, which "shows some maturity for solar as an asset class." With bond interest above 5 percent, "where can you park your money right now in the U.S. and get five-plus percent? You can't even get a percent for a CD," Praghu said. With money abundantly available thanks to friendlier federal policies, "5 percent looks like a really good bet, with a lower risk profile," he said.

... And Know When to Fold 'Em

Part of the mindset of an investor is knowing how to identify and ride an early wave of success -- and knowing when to get off the ride. In the case of the boon in solar third-party funding, "that's what a lot of people are wondering," Prabhu said. The third-party business model, which relies heavily on vendors taking the tax credits, has some fundamental uncertainty once the 30 percent investment tax credit (ITC) times out in 2016. And if prices continue to come down, will solar become so attractive that direct ownership makes more sense than leasing? As investors, particularly those who look ahead to annual tax obligations, start to look at solar investments, the thinking around these types of concerns "has to evolve pretty soon," he said.

One last data point Prabhu points out: bankruptcies and insolvencies are actually dropping, roughly half what they were at this time a year ago. "That's what I look at when I tell people, 'we're a little better off than where we were,'" he said. "But [we're] not completely off the hook."

View the original article here

Ярлыки: Cleantech, Investments, mixed, solar, warming 0 коммент.

Thursday, June 20, 2013

Top 20 women in Cleantech investment

на 10:36 PM Thursday, June 20, 2013

In 2011, the National Venture Capital Association and Dow Jones VentureSource released their study of the diversity makeup of the venture capital industry. Not surprisingly, the majority of people working in the VC industry were white and. . . wait for it. . . male. While women represented 21 percent of employment in the VC industry, only 11 percent listed themselves as actual investors. In cleantech, the number of female investors was 4 percent higher, at 15 percent. Meanwhile, as Founder of the organization Women in Cleantech & Sustainability, I know there are many female investors out there, if you know where to look. To make it simpler for everyone to applaud these women in their efforts to bring diversity to this traditionally male-dominated field, we’ve listed our top 20 here.

1. Nancy Floyd, Founder and Managing Director, Nth Power

Back in 1993, when Nancy Floyd started Nth Power, there were understandably fewer women in the sector than there are today. Floyd speculated to Gigaom in 2007 as to why the field lacks large numbers of start ups founded by women. “You just don’t have many women with backgrounds that investors would back,” she said. “You’re looking at energy industries that have been male-dominated for years and years. It’s not easy for anybody, but for investors to write a check, they’re going to want to see relevant background.” Before founding Nth Power, Floyd was a serial entrepreneur, having founded companies like NFC Energy Corp, one of the country’s first wind development firms, which, when it was sold three years later, generated a 25-fold return. Who says there's not money to be made?

2. Nancy Pfund, Managing Partner, DBL Investors

“As a woman in venture capital, I am part of a small club, and it’s part of my job to try to change that. As a woman in cleantech venture capital, the club is smaller still, but somehow it fits like a glove,” Nancy Pfund said in Forbes in 2012. Considering her groundbreaking role as a female cleantech venture capitalist, Pfund tapped into the press by writing articles featured in outlets such as Huffington Post Green and Forbes with titles like “Subsidies for Renewable Energy: American as Apple Pie” and “Women and Clean Energy: Overcoming The Double Standard.” In these articles, Pfund emphasizes her prominent position as a woman in cleantech and uses an honest and forthright tone that conveys the messages she wants to deliver as a green venture capitalist. “First, every great expansion of the American economy can be linked to the discovery of a new energy source. Second, each of these new energy industries received substantial government support at a pivotal time in its early growth.” Yet, Pfund’s enthusiasm for government investment does not define her personal career, which lies heavily in the private sector. Pfund is a partner at DBL Investors, a venture capital firm that strives to invest successfully and meaningfully in terms of social, economic and environmental change. She also sits on the boards of directors of several private companies including Primus Power, Solar City, Solaria, Ecologic, BrightSource and PowerGenix.

3. Andree-Lise Methot, Founder, Cycle Capital Management

At Cycle Capital Management, Methot assists projects in everything from water management and biofuels to community development. Cycle Capital Management strives to help potentially successful companies in cleantech and renewable energy gain the financial assistance they need. Methot received her Master’s degree in Science from Universite de Montreal. Her BA was in Geological Engineering from Universite Laval. In her career she has spent 15 years working in company financing, financial program management, and engineering.

4. Joyce Ferris, Founder and Managing Partner, Blue Hill Partners

An entrepreneur in the green technology industry for over 25 years, Ferris currently acts as the Founder and Managing Partner of Blue Hill, an investment firm with a focus in green technology that provides capital, management assistance and strategic goals for companies. Before founding Blue Hill, Ferris worked as a senior funding executive at Reading energy, an independent power company, where she managed energy projects and financial transactions totaling over $500 million. Ferris’s expertise is in helping entrepreneurial companies build high-performance culture. Recently for a project in Pennsylvania, Blue Hill built its headquarters with the hope that the facility would be home to a community of green-tech companies. As Ferris asserted to the Philadelphia Business Journal in 2010, “If you can create an environment where people are helpful and supportive and somebody learns something new about a particular piece of legislation, for instance, there’s some sharing of it, that really strengthens everybody.”

5. Diana Propper de Callejon, General Partner, Expansion Capital Partners

Diana Propper de Callejon boasts more than 20 years of experience in clean technology. Her work has spanned diverse sectors including energy, forestry water, agriculture, and advanced materials. de Callejon believes that many private companies are now created with a commitment to values of “continuous improvement in environmental performance and social impact...as a primary driver of innovation and value creation over the long term,” as she wrote in the essay Integrated Value - A New Private Model for Driving Value Creation. Prior to becoming a partner at Expansion Capital, de Callejon was a founder and Managing Director of EA Capital, a firm she co-ran for more than ten years. At EA Capital, Ms. de Callejon worked with Fortune 500 companies, financial institutions, and private equity firms to identify new business and investment opportunities related to resource efficiency and sustainability. Ms. de Callejon’s efforts to mobilize investment capital to address environmental and social problems are rooted in her sustainable development work in the 1980s and early 1990s. For six years, de Callejon worked in Africa and South America. In particular, de Callejon worked in Brazil with a trading company that extended loans to small businesses in the Amazon that harvested, processed, and exported non-timber forest products such as fruits, nuts, and essences. de Callejon has an MBA from Harvard Business School and a BA from Duke University and speaks French and Spanish.

6. Marianne Wu, Partner, Mohr Davidow Ventures

Marianne Wu is a Partner at MDV where she focuses on cleantech investments. With more than 15 years of technology development and business experience, Wu helps build meaningful, successful businesses via investments and assisting entrepreneurs. As Wu noted in Fast Company, "We look for teams of people with varied skills. As always, you need to have great entrepreneurs, people who have the energy and passion and commitment to start something. We're also looking for great technical skill and some kind of technical advantage in terms of the platform that gets the product to market at a cost point that's really exciting. You also need to know the people you'll work within the larger system. So, over time, companies need to add significant industry operating experience. The key in these biofuel and biochemical companies is marrying the entrepreneur, the technical genius, and the industry domain experience, and making that into a strong, cohesive team.”

7. Cathy Zoi, Partner, Silver Lake Kraftwerk

Cathy Zoi has over 25 years of experience in both the public and private sector working with energy and resource development and deployment. Currently, Zoi works at Silver Lake Kraftwerk, an enormous equity firm that invests in energy and technology related projects. Zoi believes our society has the willpower to fight global warming. As she wrote in The Huffington Post, “The good news is that the solutions to this crisis exist. Unlocking innovative technologies to change how we power our lives will grow new and exciting sectors of our economy, helping ensure not just a healthier plant, but a healthier economy as well.” Notably, Zoi was the founding CEO of the New South Wales Sustainable Energy Development Authority (SEDA). SEDA was a $50 million fund devoted to commercializing technologies that produced fewer greenhouse gases. Moreover, SEDA launched the first nationwide green power program that boasts the world’s largest solar-powered suburb.

8. Jill Watz, Venture Partner, Vulcan Capital

Jill Watz is a Venture Partner at Vulcan Capital, a private investment group, where she is responsible for strategy and portfolio management in the cleantech sector, with specific emphasis on solar, geothermal, nuclear, advanced materials, and water technologies. Prior to Vulcan, Watz held senior management and technical research positions at Lawrence Livermore National Laboratory in applied energy technology directing multidisciplinary research projects in oil and gas exploration and production, geothermal energy, energy storage and conversion technologies, alternative fuels, and energy and climate policy. While at LLNL, Watz also led industrial partnership development for energy technologies. In advising the Millennium Village Project’s Energy group on new technology development and business strategies, Watz is able to fulfill her passion for developing distributed energy technologies to combat poverty. She is also a participating scientist at LLNL and is a member of the Corporate Advisory Committee to Washington State University's Foundation. Watz has a BS degree in Chemical Engineering from University of California at San Diego and SM degrees in Civil and Environmental Engineering and Technology and Policy from the Massachusetts Institute of Technology.

9. Kiki Tidwell, President, Tidwell Idaho Foundation Angel; Investor, Astia, Empower Micro Systems, and Mission Investors Exchange

Kiki Tidwell is a cleantech angel investor in Seattle and President of the Tidwell Idaho Foundation, a small family foundation she started after considerable thought about inherited wealth when her daughter was born. Individually, Tidwell is a Limited Partner in several venture funds: Nth Power Fund IV, CalCEF Angel Fund, Good Capital's Social Enterprise Expansion Fund, TrueBridge Capital Fund II, and Aligned Partners. Since 2007, she has been a member of Northwest Energy Angels, a cleantech-focused angel group, and served two years on its board. She was also an advisor to the Fall 2012 Astia Global Entrepreneur Program. As she noted to Sramana Mitra for her One Million by One Million Blog, Tidwell’s interest in cleantech developed around 2003 when she was working at an industry in Idaho for rural economic development. “I was very proactive and started learning about the opportunities available in cleantech, and I realized what a huge change this was going to be and what a huge market opportunity it presented. My background is in real estate investing. Why I was interested in cleantech were the tax credits. I understood those from affordable housing–type tax credits I’d looked into. I’m also a philanthropist. . . trying to make Idaho a better place. I saw what a state could do with new industry could far eclipse what we would could do in grant making. Communities could build industries and fund their own schools and their own social needs through these new industries.” In 2009, Tidwell won the first ever successful carbon reduction shareholder initiative with a utility for her initiative with IdaCorp, Inc. It was one of only 15 successful shareholder initiatives in any category in the last 10 years.

10. Yvette Go, Partner, Chrysalix SET; Board Director, MicroShade A/S

Yvette Go is a Partner at Chrysalix SET where she focuses on companies in the areas of biofuels, biomass, waste-to-energy, energy efficiency, hydrogen, and fuel cells. She also serves as the Board Director of MicroShade A/S, a Danish technology and knowledge-based company that develops and markets advanced, transparent solar shading and photovoltaic solutions for new and refurbished buildings. An experienced investment professional for the past 15 years, Go works to build and develop businesses through maximizing value. Prior to becoming a partner at Chrysalix SET, she acted as the global Product Portfolio Manager of DSM Powder Coating Resins, a global science-based company active in health, nutrition, and materials. While at DSM, Go was selected to represent the company on the 2004 Young Managers Team (Future Leaders Team) of the World Business Council for Sustainable Development where she led a sub-team focused on China’s capacity building and Sustainable Business promotion. Feeling that the work she had accomplished at YMT gave her a wider outlook on sustainable development, both within the YMT and beyond, Go noted in an interview, “I consciously look for opportunities to work sustainable development into the marketing and sales area at DSM. That means challenging myself and others to be more aware about the environmental and social impact of business and asking more questions about how we do things.” Go holds a Master's degree in Business Administration from IESE Business School (Global Executive MBA 2008) and a Master of Science in Chemical Engineering.

Don't forget to submit a nomination for the 2013 Power-Gen Woman of the Year Award here.

The information and views expressed in this blog post are solely those of the author and not necessarily those of RenewableEnergyWorld.com or the companies that advertise on this Web site and other publications. This blog was posted directly by the author and was not reviewed for accuracy, spelling or grammar.

View the original article here

1. Nancy Floyd, Founder and Managing Director, Nth Power

Back in 1993, when Nancy Floyd started Nth Power, there were understandably fewer women in the sector than there are today. Floyd speculated to Gigaom in 2007 as to why the field lacks large numbers of start ups founded by women. “You just don’t have many women with backgrounds that investors would back,” she said. “You’re looking at energy industries that have been male-dominated for years and years. It’s not easy for anybody, but for investors to write a check, they’re going to want to see relevant background.” Before founding Nth Power, Floyd was a serial entrepreneur, having founded companies like NFC Energy Corp, one of the country’s first wind development firms, which, when it was sold three years later, generated a 25-fold return. Who says there's not money to be made?

2. Nancy Pfund, Managing Partner, DBL Investors

“As a woman in venture capital, I am part of a small club, and it’s part of my job to try to change that. As a woman in cleantech venture capital, the club is smaller still, but somehow it fits like a glove,” Nancy Pfund said in Forbes in 2012. Considering her groundbreaking role as a female cleantech venture capitalist, Pfund tapped into the press by writing articles featured in outlets such as Huffington Post Green and Forbes with titles like “Subsidies for Renewable Energy: American as Apple Pie” and “Women and Clean Energy: Overcoming The Double Standard.” In these articles, Pfund emphasizes her prominent position as a woman in cleantech and uses an honest and forthright tone that conveys the messages she wants to deliver as a green venture capitalist. “First, every great expansion of the American economy can be linked to the discovery of a new energy source. Second, each of these new energy industries received substantial government support at a pivotal time in its early growth.” Yet, Pfund’s enthusiasm for government investment does not define her personal career, which lies heavily in the private sector. Pfund is a partner at DBL Investors, a venture capital firm that strives to invest successfully and meaningfully in terms of social, economic and environmental change. She also sits on the boards of directors of several private companies including Primus Power, Solar City, Solaria, Ecologic, BrightSource and PowerGenix.

3. Andree-Lise Methot, Founder, Cycle Capital Management

At Cycle Capital Management, Methot assists projects in everything from water management and biofuels to community development. Cycle Capital Management strives to help potentially successful companies in cleantech and renewable energy gain the financial assistance they need. Methot received her Master’s degree in Science from Universite de Montreal. Her BA was in Geological Engineering from Universite Laval. In her career she has spent 15 years working in company financing, financial program management, and engineering.

4. Joyce Ferris, Founder and Managing Partner, Blue Hill Partners